Fund Flow Monitor

摘要: Weeklyrecap:Moresectorsfellintobearzoneamidweakoverallmarket.Newsectorsinthestrongzonethisweekinclud

Weekly recap:

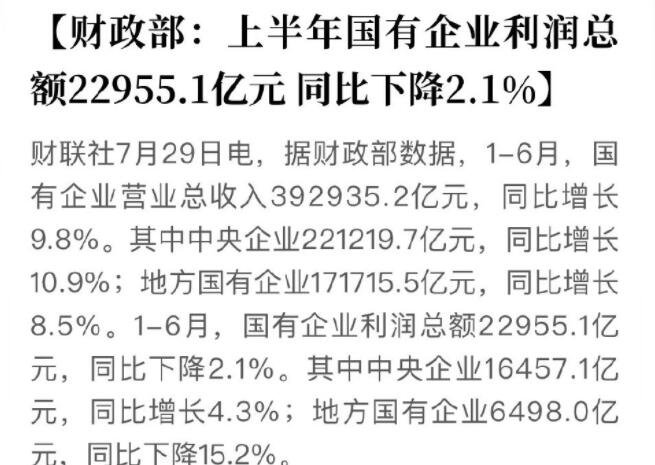

More sectors fell into bear zone amid weak overall market.New sectors in the strong zone this week included air transport and water & waste treatment, thanks to declining oil prices and supportive government policy, respectively. Though the number of sectors in the undervalue zone decreased to 2 from 3, the broad market seemed to have found support as China properties and oil & gas are both cyclical sectors with high beta.Nevertheless, overall sector momentum was still weak as sectors in the overvalue zone increased to 3 from 1, and they are cyclical sectors. Sectors in the weak zone increased sharply to 7 from 1. The bullish sectors for the week include:

i) Water & waste treatment, ii) Air transport, iii), Consumer fashion & apparel, iv) China properties, & v) Oil & gas.

Sectors in highlight:

Air transport: China Southern Airlines (1055) and China Eastern Airlines (670) both recorded a 10% increase in market cap amid falling oil prices.

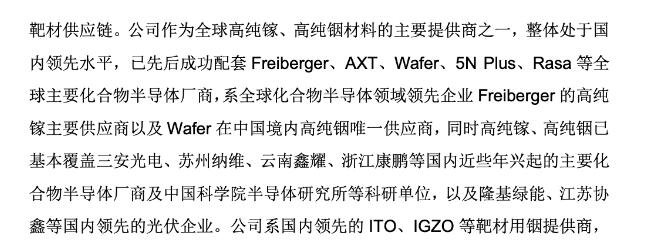

Construction materials: The sector was an indirect beneficiary of the “One Road, One Belt” plan and a beneficiary of the government’s cap on new capacity restruction. Shanshui Cement (691), China Resources Cement (1313), Anhui Conch (914) and China National Building Material (3323) all posted strong fund inflow last week.

Weekly investment themes:

Dairy products: Since December, fund began to flow into the sector and led the market cap to bottom out. As China is toughening its examination of milk powder imported from New Zealand after revelations emerged of a criminal threat to contaminate some products with an agricultural poison, the market expects it will bode well to domestic producers. We’ve seen large fund inflow to China dairy sector, in particularly to sector leader including Mengniu Dairy (2319 HK) and Modern Dairy (1117 HK).

Water & waste treatment: Having seen fund outflow on the back of sector rotation, the sector began to see fund flowing back and expanding market cap on a series of supportive government policies from February. BEWG (371), one of the leaders in China’s sewage treatment industry, record strong fund inflow last week after the company recently raised its targets for water treatment capacity and expanded into sludge treatment business. Fund continued to flow into the sector despite recent market cap retreat, suggesting that the sector was still in a medium term uptrend.京华山一国际(香港)有限公司

wastetreatment,from,Water,Airtransport,HK