Weekly Fund Flows:More of the same for global equity funds

摘要: Lastweek’s(Wed-Wed)reviewoffunds’in/outflowsas%offunds’AuM.Lastweek’sglobalflowsrevealedacleanrisk-o

Last week’s (Wed-Wed) review of funds’ in/outflows as % of funds’ AuM.

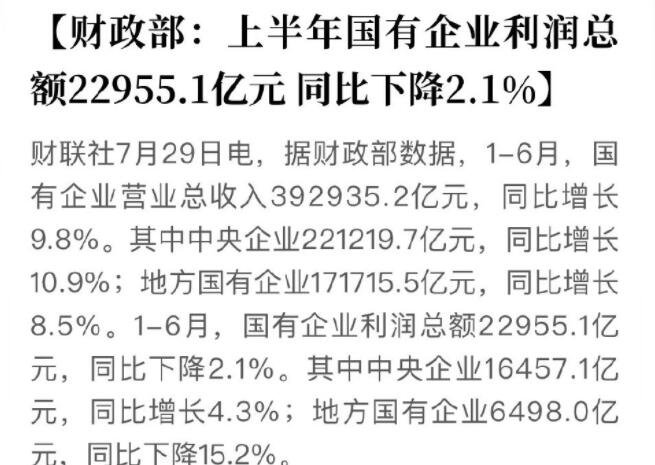

Last week’s global flows revealed a clean risk-off sweep with multiple-weekhigh outflows for all equity regions, credit, and EM bonds, while sovereignfunds (first inflows since February) and money markets (biggest inflows sinceFebruary) gained. Global equity markets in particular experienced strongoutflows for a seventh week in a row as investors continued reducing theirexposure to equity despite soothing economic data and rising stock prices.

Year-to-date equities have lost a staggering 100 USDbn with 4.5-year highoutflows over the last three months alone (see charts on the right).

European equity funds once again posted the biggest outflows across regionsin the 16th week of continuous redemptions, with US-domiciled redemptionsnow accounting for almost one-third of the overall outflows year-to-date. Anduncertainty for the region is unlikely to abate as June waits on with the UKvoting on EU membership, and Spain voting on a new parliament. The formerstarted causing concern among domestic fund managers with 1-year highoutflows for UK equity funds over the past four weeks, solely driven by pounddenominatedETF redemptions.

Across asset classes – MM (+), bonds (+) vs equities (-): Broad-based mutualfund redemptions dragged down total equity flows (-0.1%, MFs: -0.2%, ETFs:+0.1%). Equity funds suffered outflows across all major regions, with DMmutual funds in particular sinking to year-to-date low inflows (-0.2%). Bondfund inflows decelerated to an 8-week low (+0.1%) burdened by 15-week highredemptions from US and European high-yield mandates (-0.4%) amidincreasing Fed hike prospects. Meanwhile MM funds (+0.3%) saw 15-weekhigh inflows as investors chose to err on the side of caution instead.

DM equity funds (-) with broad-based MF redemptions: Overall redemptionsfor DM equity funds were broad-based (-0.1%, MFs: -0.2%, ETFs: +0.1%) withmost losses seen across European (-0.3%, MFs: -0.2%, ETFs: -0.6%) andJapanese equity funds (-0.3%, MFs: -0.3%, ETFs: -0.3%), while US ETF inflowshelped to absorb the 48th continuous week of US mutual fund redemptions(-0.0%, MFs: -0.2%, ETFs: +0.2%).

EM equity funds (-) with losses across the board: EM funds witnessed lossesacross both mutual fund and ETF categories as well as across regions (-0.3%,MFs: -0.2%, ETFs: -0.5%). Losses were strongest for EMEA equity funds(-0.8%, MFs: -0.7%, ETFs: -0.9%) with LatAm mandates (-0.5%, MFs: -0.6%,ETFs: -0.5%) and Asia ex-Japan mandates (-0.2%, MFs: -0.2%, ETFs: -0.1%)following suit.

Bond funds (+) with Sov (+) vs HY (-) and EM bonds (-): Inflows into total bond(+0.1%) funds prevailed for the 8th straight week as sovereign bonds (+0.2%)experienced the first inflows in 15 weeks, driven by 2-month high inflows intoEuropean sovereign mandates (+0.3%). High-yield redemptions (-0.4%)continued for the 4th week in succession, with US high-yield mandates (-0.5%)bearing the brunt of outflows. On the contrary IG mandates carried their inflowstreak into the 14th week. Japanese bond flows (-0.5%) added another weekof redemptions and extending the negative streak which started when theBank of Japan announced its negative interest rate policy in February. EM debtfund flows (-0.1%) have turned negative over the past couple of weeks,coming off 12 weeks of successive inflows.德意志银行

0.2,MFs,ETFs,0.1,0.3